The lack of housing supply is partly responsible for surprisingly high competition rates.

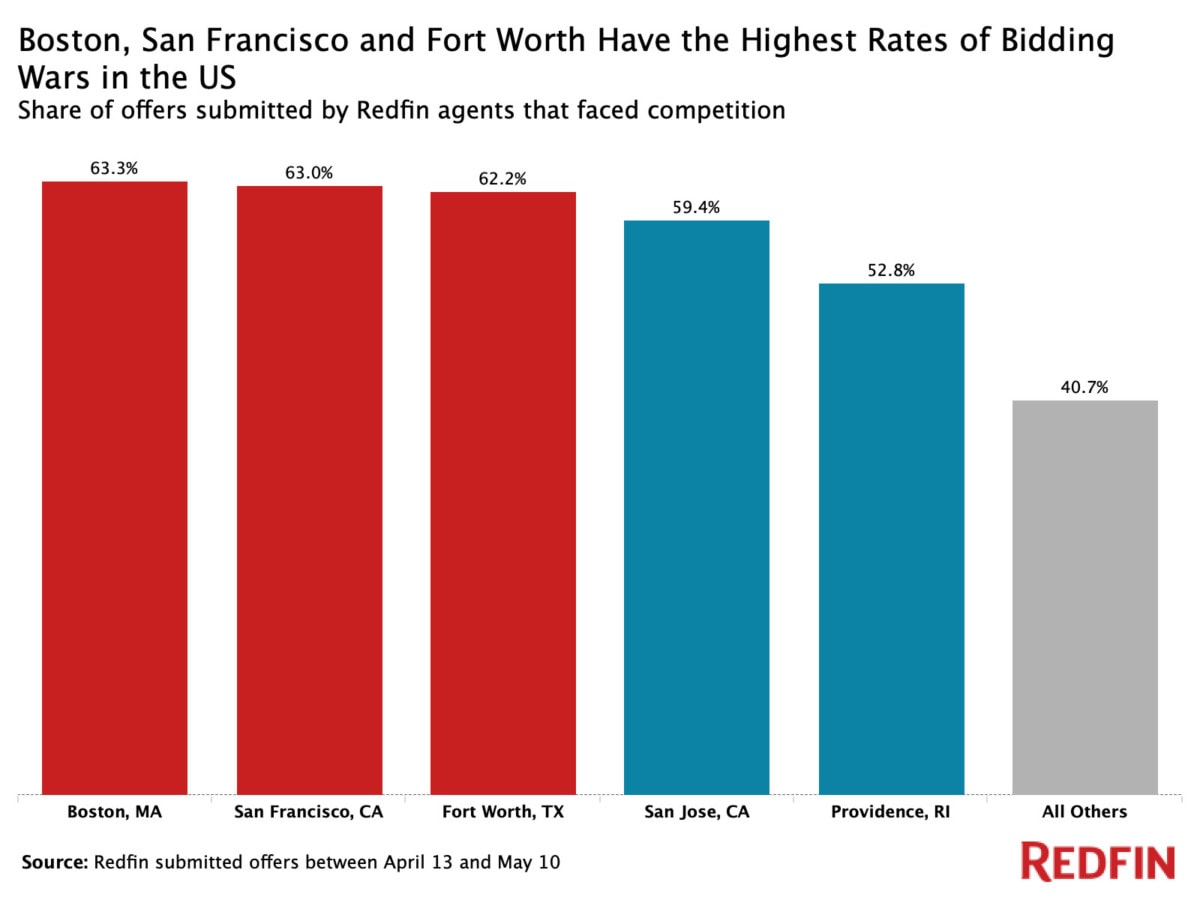

Nationwide, 41.1% of Redfin offers faced competition in the four weeks ending on May 10. In a handful of metros, the bidding war rate was above 60%.

The coronavirus pandemic is contributing to a shortage in the number of homes for sale across the U.S. as would-be sellers hold off on listing their homes amid ongoing uncertainty. The lack of inventory has led to a significant amount of bidding wars, particularly for single-family homes priced under $1 million in desirable areas.

Even before the novel coronavirus took hold in the U.S., home supply was at its lowest point in seven years. The recent lack of new listings—they hit a low point with a 50% year-over-year decline during the second week of April and were still down 30% year over year in the first week of May—has made the shortage even more severe.

“Demand for homes has picked back up after hitting rock bottom in April, and that uptick paired with a lack of supply is a recipe for bidding wars,” said Redfin lead economist Taylor Marr. “Homebuyers are getting back out there, searching for more space as they realize using their home as an office and school may become the norm. But sellers are still holding off on listing their homes, partially due to economic uncertainty and concerns of health risks. In some hot neighborhoods, there may only be one or two homes for sale, with multiple homebuyers vying for them.”

San Francisco, Fort Worth and Boston Were Home to the Most Competitive Markets

Boston had the highest rate of competition in the four weeks ending May 10, with 63.3% of offers written by Redfin agents on behalf of their homebuying customers facing bidding wars. San Francisco and Fort Worth, TX trail closely, with bidding war rates of 63% and 62.2%, respectively. Then come two coastal metros: San Jose (59.4%), Providence, RI (52.8%), which round out the list of metro areas where a majority of Redfin offers faced competition.

To be included in this analysis, metros must have had at least 20 offers written by Redfin agents from April 13 to May 10. A home is considered part of a bidding war if it receives more than one offer.

“Nearly every offer in the Fort Worth area is facing competition right now,” said Redfin agent Crystal Zschirnt. “During the first week of May, one of my clients made an offer on a house that ended up with 17 total offers. The only homes that are sitting on the market without multiple offers are overpriced.”

“The fierce competition is due to low inventory,” Zschirnt continued. “Sellers in my area aren’t listing their homes at nearly the same rate they did before the pandemic, partly because they don’t want potential buyers walking through their homes, particularly people who aren’t seriously searching or aren’t yet qualified.”

In Tampa, FL, 16.7% of offers faced competition, the lowest rate of any metro area included in this analysis. The metros with the second and third lowest bidding-war rates are also in the South: Nashville (20.8%) and Fort Lauderdale (21.7%). They’re followed by West Palm Beach (25%) and Lake County, IL (27.6%).

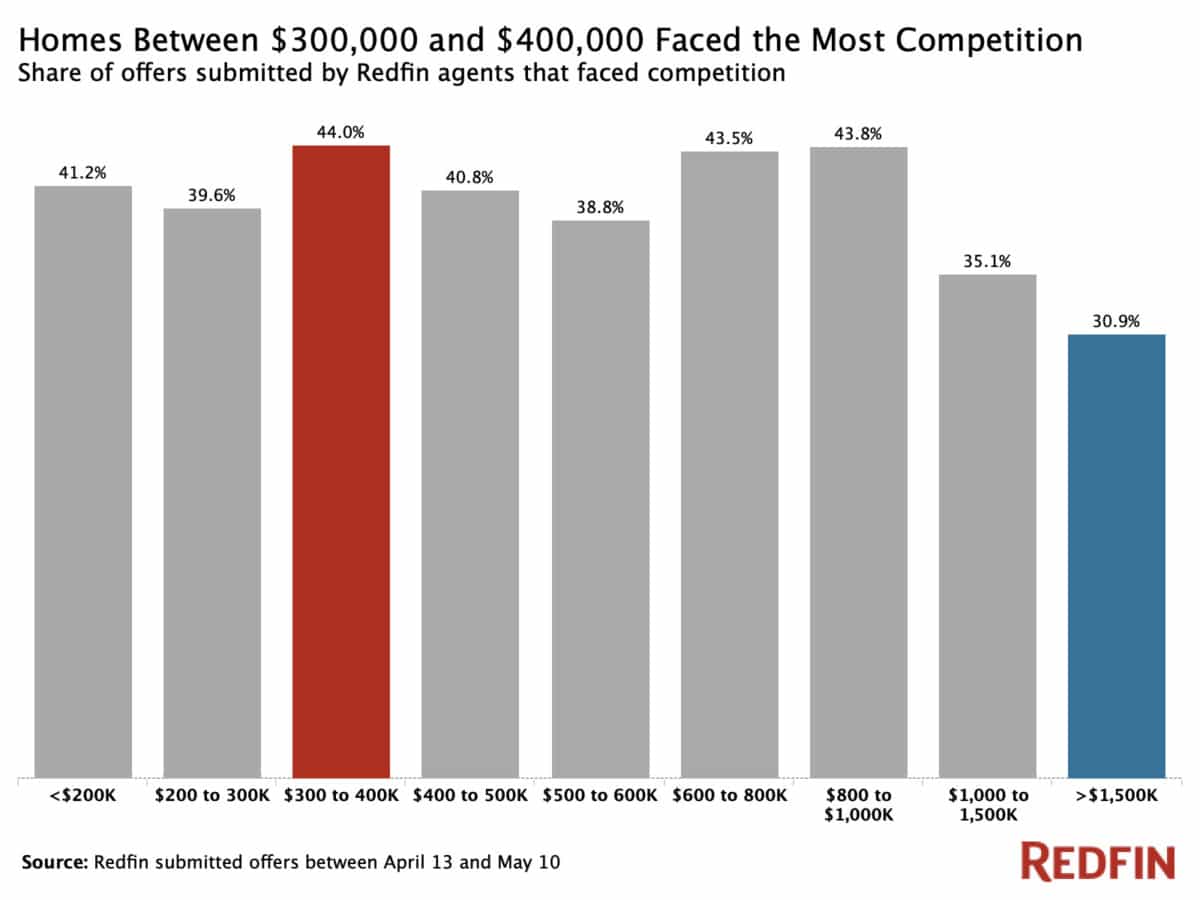

Homes Priced Under $1 Million Were Most Likely to Face Bidding Wars

Nationwide, homes with list prices under $1 million were more likely to receive multiple offers than homes priced above that threshold.

Homes in the $300,000 to $400,000 range faced bidding wars 44% of the time, more frequently than any other price bucket, although it’s followed very closely by the $800,000 to $1 million bucket (43.8% bidding-war rate) and the $600,000 to $800,000 range (43.5%).

Although there’s not much variation between the sub-$1 million price buckets, the rate of competition is notably lower for more expensive homes, which is likely partly due to tighter lending standards that are making it more difficult to obtain jumbo loans. Homes priced at $1 million to $1.5 million faced bidding wars 35.1% of the time, and homes priced over $1.5 million faced competition 30.9% of the time.

“I’m still seeing competition for affordable homes in desirable neighborhoods, even as Washington state’s stay-at-home order continues,” said David Hokenson, a Redfin agent in the Seattle area. “One of my clients made an offer for a home listed at $360,000 in the Renton Highlands, a neighborhood in a Seattle suburb. Even though the home was outdated and hadn’t been renovated since the 1960s, it was one of 24 total offers. That home ended up selling for well above asking price.”

Of all price buckets in all metro areas included in this analysis, homes priced from $200,000 to $300,000 in Fort Worth had the highest bidding-war rate, with 75% of offers facing competition. It’s followed by the $400,000 to $500,000 price bucket in Boston (70% bidding-war rate) and the $600,000 to $800,000 bucket in Oakland (61.9%).

Single-Family Homes Were More Likely to Receive Multiple Offers Than Condos or Townhouses

Nationwide, 42.8% of offers for single-family homes submitted during the four weeks ending May 10 faced competition. That’s followed by townhouses (38.8%) and condos (33.2%).

Of the three property types in all metro areas included in this analysis, single-family homes in Boston had the highest bidding-war rate (66.2%). It’s followed by single-family homes in Fort Worth (62.2%) and single-family homes in Providence (58.6%).

Here’s a metro-level look at bidding war rates for the time period April 13 to May 10:

| Metro area | Share of Redfin offers that faced competition in the four weeks ending May 10 |

| Boston, MA | 63.3% |

| San Francisco, CA | 63% |

| Fort Worth, TX | 62.2% |

| San Jose, CA | 59.4% |

| Providence, RI | 52.8% |

| Cleveland, OH | 52.2% |

| Virginia Beach, CA | 50% |

| Frederick, MD | 49% |

| Worcester, MA | 48.5% |

| Orlando, FL | 47.8% |

| Baltimore, MD | 47.7% |

| Washington, DC | 47.5% |

| Oakland, CA | 47.2% |

| San Antonio, TX | 46.7% |

| Portland, OR | 45.7% |

| Seattle, WA | 44.8% |

| Tacoma, WA | 43.5% |

| Minneapolis, MN | 43.1% |

| Austin, TX | 43% |

| Riverside, CA | 42.9% |

| Indianapolis, IN | 42.9% |

| San Diego, CA | 42.6% |

| Salt Lake City, UT | 42.5% |

| Las Vegas, NV | 42.3% |

| Denver, CO | 41.6% |

| Dallas, TX | 41.3% |

| Los Angeles, CA | 39.8% |

| Raleigh, NC | 38.2% |

| Atlanta, GA | 38.1% |

| Sacramento, CA | 36.7% |

| Charlotte, NC | 36.4% |

| Phoenix, AZ | 36.3% |

| Columbus, OH | 36% |

| Anaheim, CA | 35.1% |

| Elgin, IL | 35% |

| Houston, TX | 34.3% |

| Camden, NJ | 31.8% |

| Chicago, IL | 30.5% |

| Lake County, IL | 27.6% |

| West Palm Beach, FL | 25% |

| Fort Lauderdale, FL | 21.7% |

| Nashville, TN | 20.8% |

| Tampa, FL | 16.7% |

The post 41% of Redfin Offers Faced Bidding Wars in Late April, Early May Amid Coronavirus Pandemic appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.