The U.S. forbearance rate measuring the share of mortgages with suspended payments increased for the second consecutive week in nearly five months from 5.48% to 5.54%, according to the Mortgage Bankers Association. The MBA now estimates the number of homeowners in some form of mortgage forbearance increased from 2.7 million to 2.8 million this past week.

Prior to the slight increases, the U.S forbearance rate had either fallen or remained flat since forbearances decreased for the first time in the series history on June 22. However, the MBA said more people entered forbearance than exited this week.

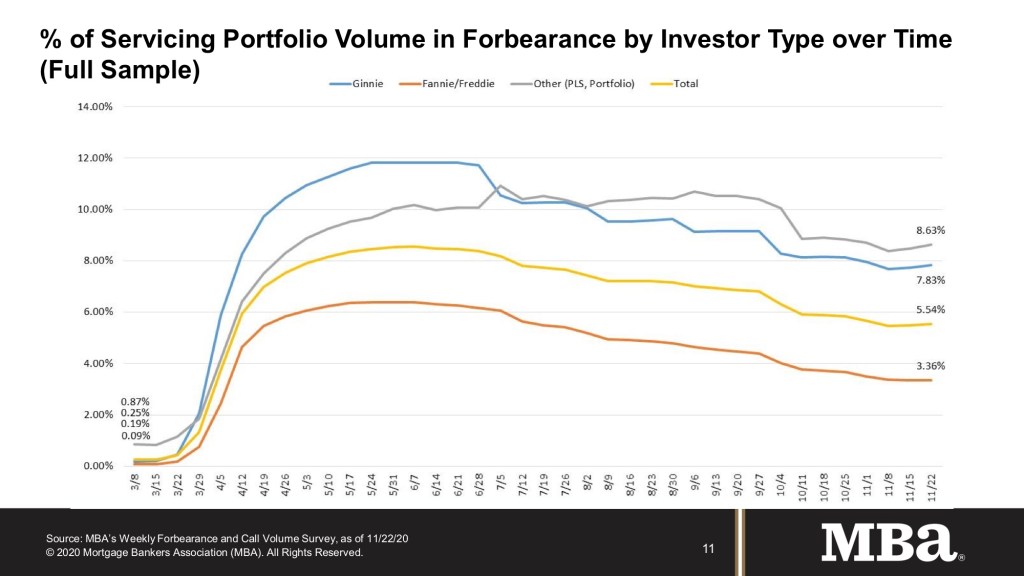

While the rate of forbearance increased across all loans and servicer types, for the first time in 25 weeks, the share of Fannie Mae and Freddie Mac loans in forbearance increased to 3.36% — a 1-basis-point gain. The forbearance rate for Ginnie Mae loans, which include loans backed by the Federal Housing Administration, also gained 10 basis points to 7.83%.

The percentage of loans in forbearance for depository servicers rose 3 basis points to 5.47%, while the percentage for independent mortgage bank servicers gained 9 basis points to 6.03%.

The forbearance share for portfolio loans and private-label securities experienced the greatest spike last week after it gained 15 basis points to 8.63%.

“The increase in new forbearance requests may be the result of additional outreach to homeowners who had previously not taken advantage of forbearance opportunities,” said Mike Fratantoni, MBA’s senior vice president and chief economist. “However, the slowing rate of exits to a new survey low further highlights that borrowers still in forbearance are increasingly challenged by the renewed restrictions on economic activity to contain the surge in COVID-19 cases.”

What kind of struggle borrowers are facing may not be quantifiable. However, of the cumulative forbearance exits from the period of June 1 through Nov. 22, the number of borrowers who continued to make their monthly payments during their forbearance period fell slightly to 30.3% from 30.5%.

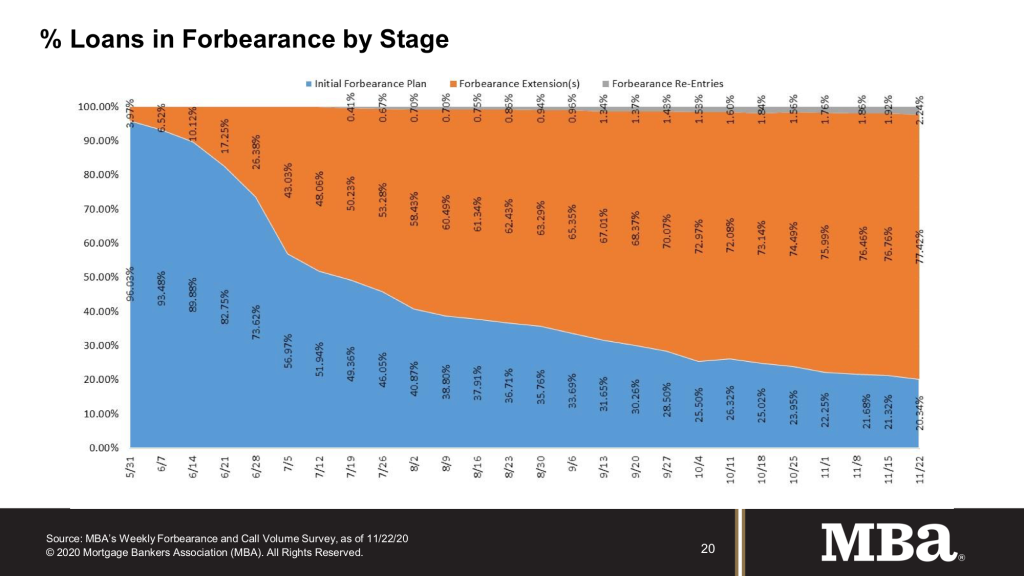

The MBA also revealed that while forbearance exits fell behind, the total number of loans in forbearance extensions gained to 77.42% as borrowers chose to take advantage of relief past the initial six-month term.

Additionally concerning, said Fratantoni, was the number of borrowers who were seeking relief again – pushing the share of forbearance re-entries up to 2.24% from 1.92% the week prior.

Previously, Fratantoni urged borrowers to contact their servicers for relief and access to options, however, as a percent of servicing portfolio volume, calls to servicer centers decreased from the previous week and the abandonment rate for calls also climbed.

Despite these recent gains, Fratantoni noted that relative housing market data remained quite strong, with the MBA expecting the market is still in a position for additional growth through 2021. Supplemental support is likely needed to get through the winter though, he said.

But the deadline for receiving support is fast approaching. The cutoff for single-family homeowners to request forbearance ends on Dec. 31, 2020, for loans backed by the FHA and the Federal Housing Finance Agency – the same day the foreclosure moratoria are also set to expire.

The post Share of mortgage loans in forbearance ticks up for second week appeared first on HousingWire.