Despite what many believe, Gen Z and Millennials do want to become homeowners and they’re excited by the prospect. However, they face different obstacles than their parents and grandparents did. These challenges include lack of mortgage education, lack of suitable housing supply, and an unprecedented amount of debt that limits buying power and makes them fearful of taking on more. Any long-term effects on the attitudes and intentions due to COVID-19 are still unknown, but we have yet to see indications of major changes in sentiment.

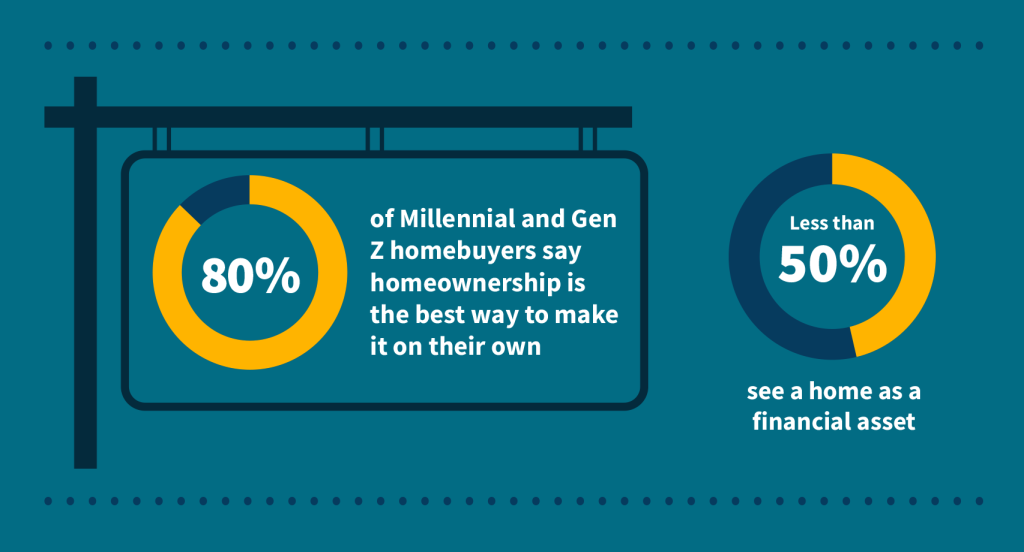

In a 2019 Fannie Mae survey of homebuyers aged 18-34, 88% said they are confident they will achieve homeownership someday. But contrary to previous generations, their desire to be homeowners is more emotionally driven than financial. 80% say homeownership is the best way to make it on their own, and less than 50% say they want to use their home as an asset.

As for what they desire in a home, 69% say they are open to a smaller home as long as it meets their needs. According to the Joint Center for Housing Studies, between 2018 and 2023, there is expected to be a 7% rise in homebuyers who are single and a 6% increase in those who are married with no children, which may signal the need for smaller homes. Smaller homes, however, are in short supply, in comparison to the larger homes that previous generations sought. 63% also say that they are open to fixer-uppers but, despite their flexibility, only 31% believe they would be able to find a home in their price range.

Among their biggest struggles is the high amount of debt that plagues these generations, in part, due to the rising costs of higher education. According to Northwestern Mutual’s 2019 Planning and Progress Study, U.S. adults aged 18+ report having an average of $29,800 in personal debt, exclusive of mortgages. This could be one of the many reasons that 55% of those surveyed believe homeownership is out of reach financially.

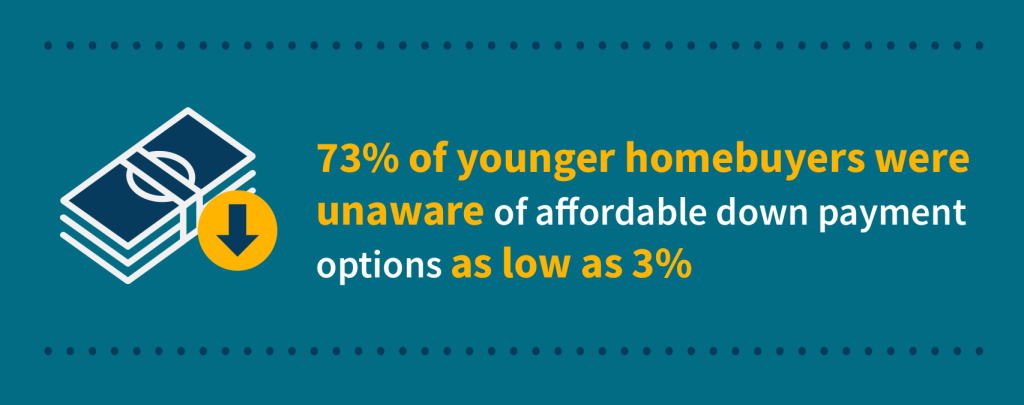

There is also a considerable lack of education preventing younger homebuyers from taking the next step. For instance, 73% were unaware of affordable down payment mortgage options, as low as 3%. Fannie Mae findings also indicate a low awareness of affordable housing solutions that go beyond traditional site-built models. Only 39% of respondents were aware of manufactured homes as a more affordable option. And when shown what the newest generation of manufactured homes looks like, the number of respondents who were interested increased by 31%.

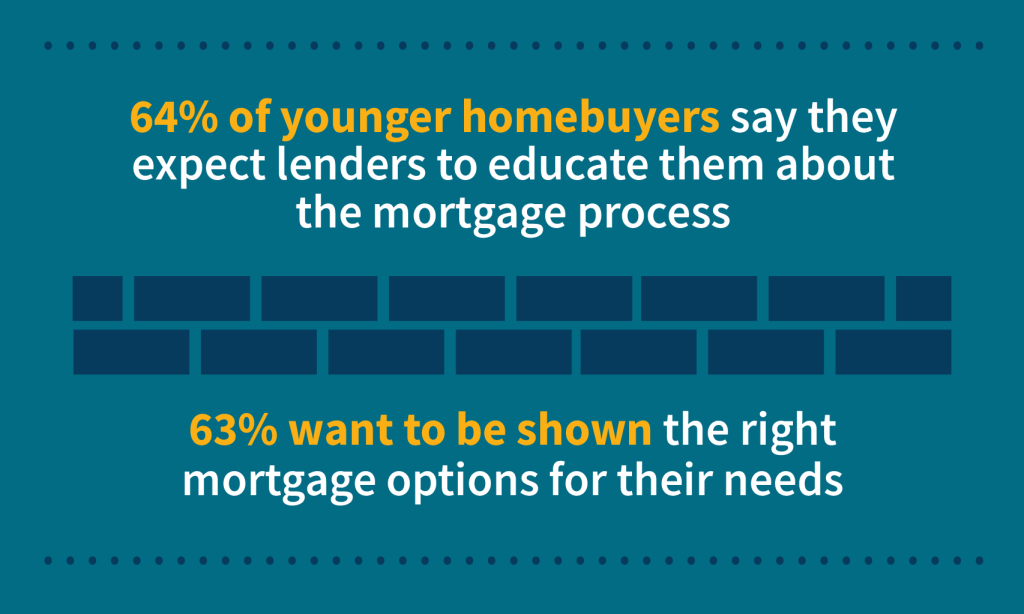

The silver lining, however, is that housing professionals have an opportunity to help reach these generations simply by understanding their needs. 64% said that they expect lenders to educate them about the mortgage process, and many future homebuyers can benefit from housing counseling from a HUD-approved nonprofit housing counseling agency. As an industry, if we are willing to step into that advisory role, we can be more successful in helping prospective homebuyers become homeowners.

Learn more about housing affordability at FannieMae.com/Affordable

Fannie Mae, “Future Homebuyers,” Single-Family Strategy & Insights unpublished research (November 2019). | Fannie Mae, “Manufactured Housing,” Single-Family Strategy & Insights unpublished research (December 2019). | McCue, “Updated Household Growth Projections: 2018-2028 and 2028-2038,” Joint Center for Housing Studies (December 2018). | “Planning & Progress Study 2019: The Debt Debacle,” Northwestern Mutual (2019).

The post Younger generations want to become homeowners – Here’s how the housing industry can help appeared first on HousingWire.