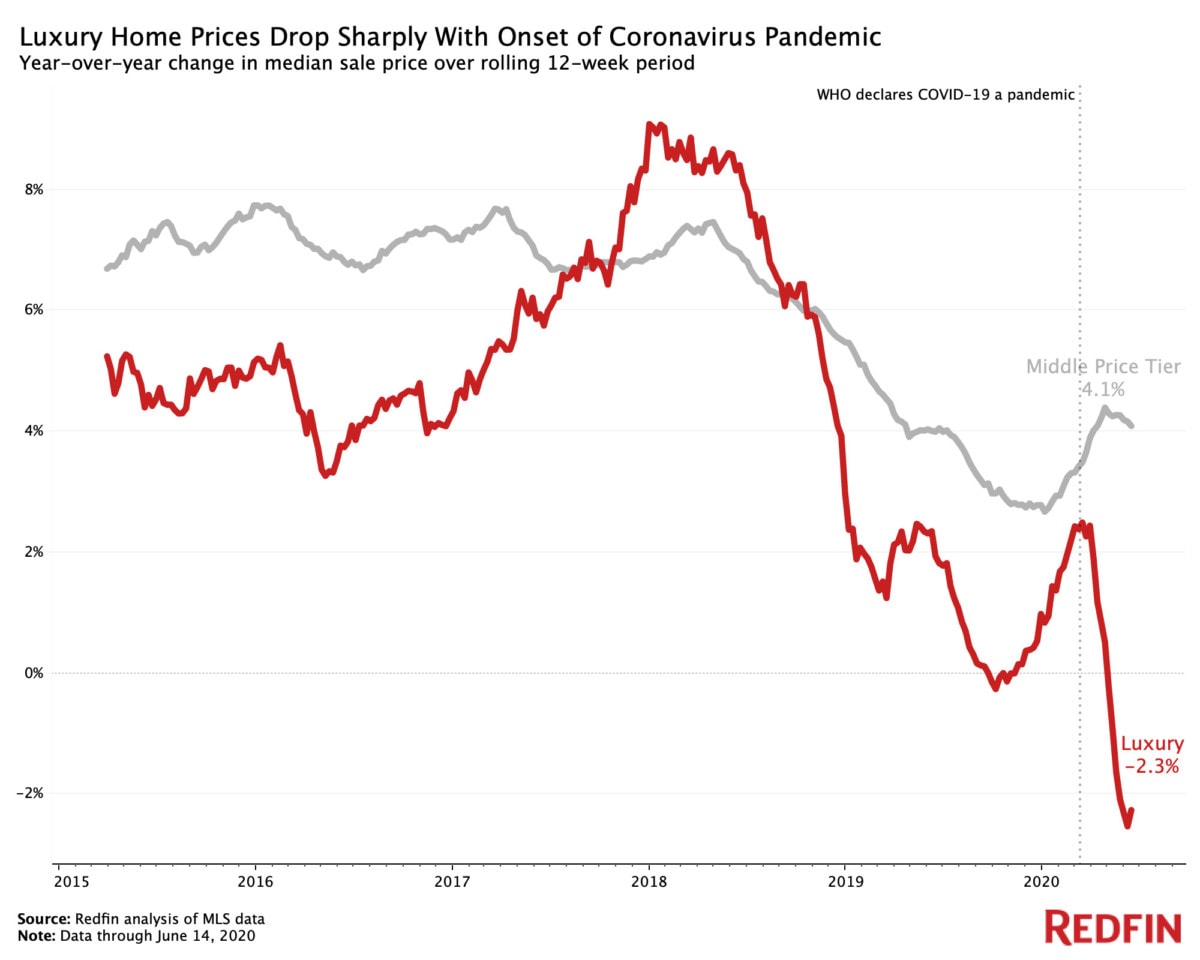

Momentum in high-end home-price growth changed course with the onset of the coronavirus pandemic, but the latest data shows luxury home prices are starting to rebound.

The median sale price for luxury homes nationwide dropped 2.3% year over year to $1,099,521 in the 12 weeks ending June 14, one of the biggest declines since at least the beginning of 2015. But the latest data shows the luxury market may be starting to rebound, with the median sale price for homes in the top 5% rising 3.5% year over year for the 7-day period ending June 14 (the shorter timeframe has a smaller sample size and is less indicative of long-term trends, but provides a snapshot of recent numbers).

This is according to an analysis that divided all U.S. residential properties into five tiers based on Redfin Estimates of the homes’ market values as of mid-June. This report defines “luxury” as all the homes estimated to be in the top 5% based on market value. To represent non-luxury homes, we use the “middle” price tier, i.e. homes estimated to be in the 36th to 65th percentile for value. Redfin typically reports luxury data on a quarterly basis; we are releasing this analysis early because we noticed a reversal in luxury home-sale price growth correlated with the onset of the pandemic.

Luxury price growth reversed course with the impact of the coronavirus pandemic: Price growth for homes in the top 5% had been on the upswing from October 2019 until March. The median luxury price started declining in the 12 weeks ending March 29 and saw its biggest dip (-2.5% YoY) in the 12 weeks ending June 7.

The top 5% of the market took a bigger hit from the pandemic than the rest of the housing market. The median sale price for non-luxury, mid-priced homes rose 4.1% year over year to $265,134 in the 12 weeks ending on June 14. Price growth for non-luxury homes started to reverse in mid-April after an upswing that started at the beginning of the year.

Housing market summary, 12 weeks ending June 14

| Luxury (top 5% by market value) | Non-luxury (36th to 65th percentile by market value) | |

|---|---|---|

| Median sale price | $1,099,521 | $265,134 |

| Median sale price, YoY | -2.3% | 4.1% |

| Number of homes for sale, YoY | -6.7% | -17.2% |

| New listings of homes for sale, YoY | -19.3% | -25.8% |

| Sales of homes, YoY | -29.9% | -21.9% |

| Median days on market | 53.5 (-1.3 YoY) | 33.8 (-2 YoY) |

“The pandemic is playing an outsized role in the luxury market, as very expensive homes are particularly sensitive to periods of economic uncertainty,” said Redfin economist Taylor Marr. “Many luxury buyers are nervous about pouring money into an investment that may be difficult to sell if the economy takes a nosedive. By comparison, people buying starter homes they plan to live in for 10 years are less concerned with volatile financial markets as long as they have money for a down payment and can afford monthly mortgage payments. And although access to credit is loosening up now, it tightened considerably for jumbo loans, which a lot of luxury buyers use, in April and May.”

But the price increase seen in the week of June 7 to June 14 indicates that some luxury buyers are back in the market. Looking forward, prices for luxury homes may continue to experience a slight uptick as panic about the economy subsides.

“Luxury home prices have likely already bottomed out. Price growth may continue to be lower than last year through the summer and fall, but with smaller drops as the months go on,” Marr said. “The fact that prices increased in the beginning of June may represent pent-up demand because buyers held off during the height of pandemic panic. The top end of the real estate market will recover more slowly than the rest of it.”

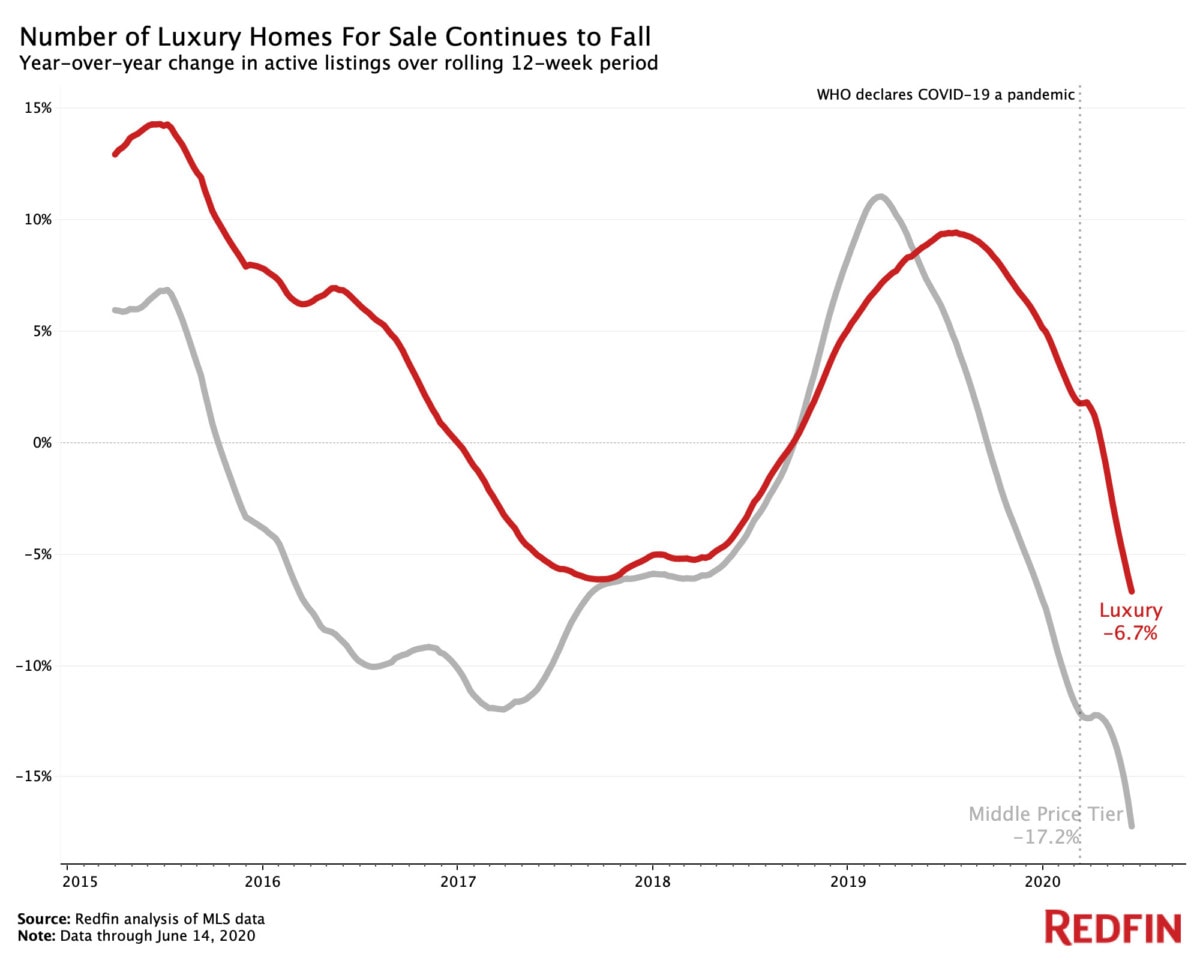

The number of luxury homes for sale dropped 6.7% year over year during the 12 weeks ending June 14, while the supply of non-luxury homes for sale declined 17.2%. The drop in luxury supply may catch up with that of non-luxury supply because of the lag seen in the chart below. Supply growth started to drop pre-pandemic for both segments, with non-luxury homes seeing a decline first, in March 2019. Because luxury supply growth started to reverse a half-year later, the decline may soon catch up, especially because luxury homes tend to stay on the market longer before going under contract (a median of 53.5 days versus 33.8 days).

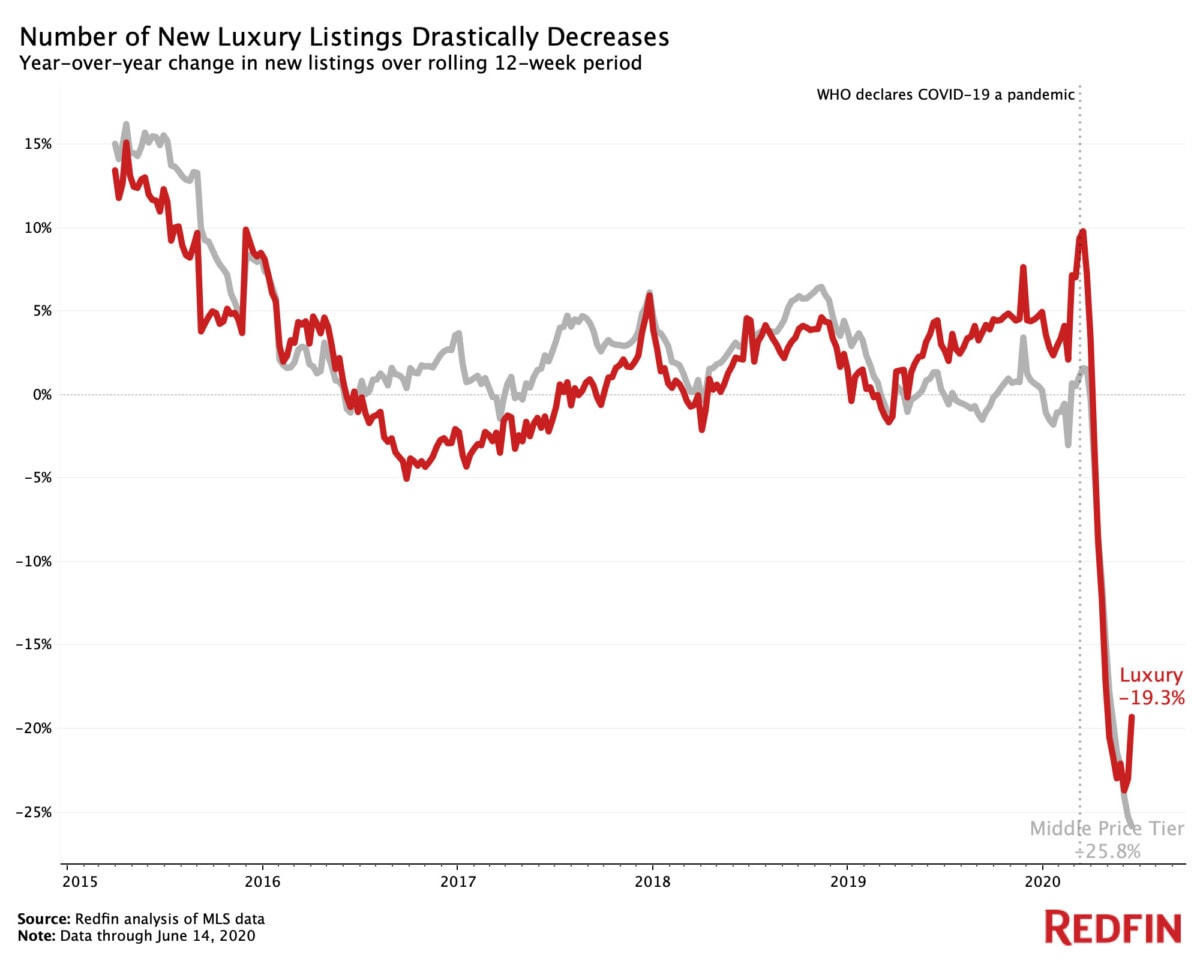

New listings of luxury homes fell 19.3% annually over the same time period, compared with a 25.8% drop for non-luxury homes. New listings in both segments of the market were rising pre-pandemic, though the peak year-over-year increase was higher for luxury than non-luxury homes (10.2% versus 1.6% in the 12 weeks ending March 15).

While the drop in new listings has been continuous since March for non-luxury homes, it has started to recover for the luxury market, which experienced its biggest new-listing decline (-23.7% YoY) in the 12 weeks ending May 31.

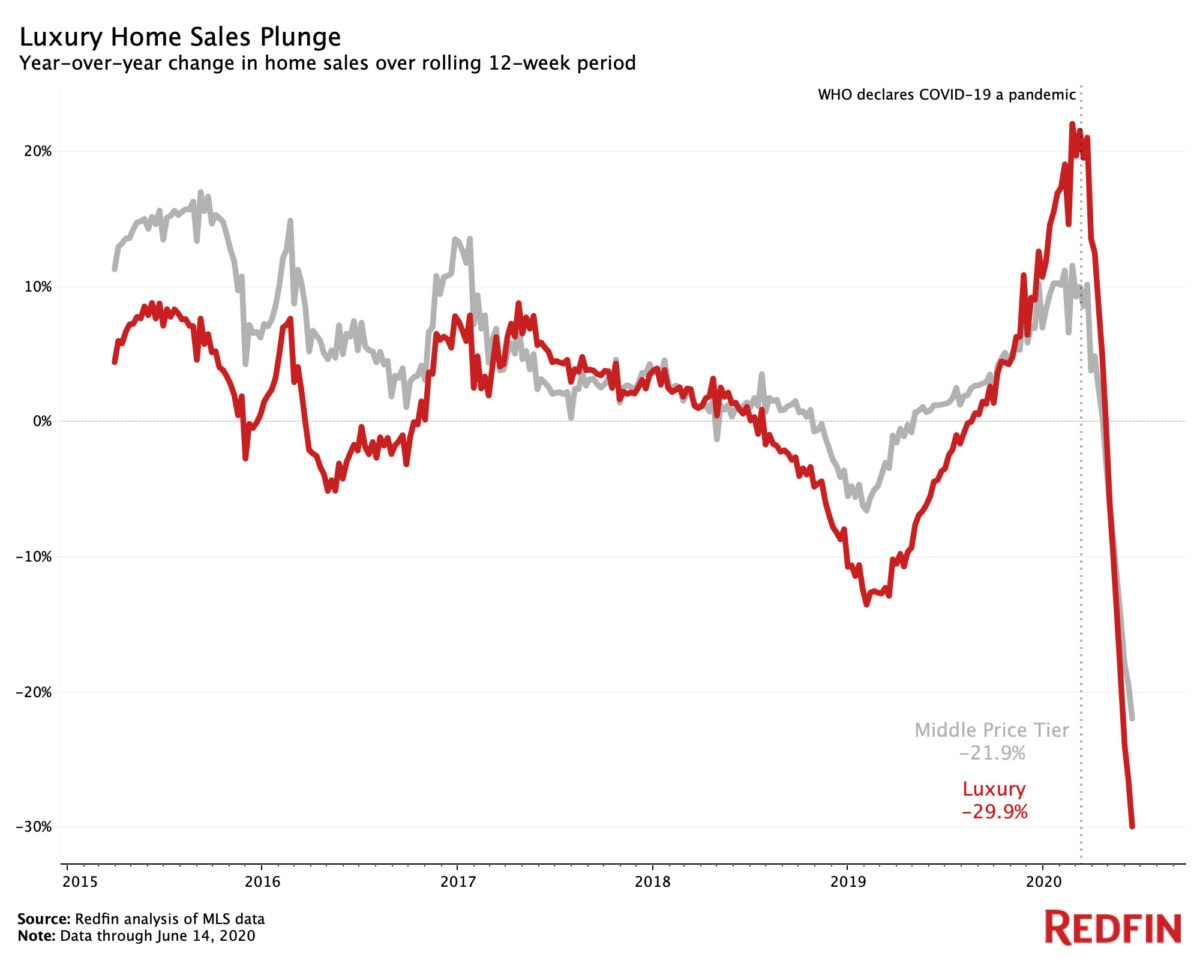

Sales of luxury homes, which had been rising since last September, also reversed course and started to decline in April. Luxury sales were down 29.9% year over year in the 12 weeks ending June 14, and non-luxury sales dropped 21.9%.

A handful of metro areas drove the overall decline in luxury sale prices. Prices of high-end homes in Dallas dropped 12% year over year in the 12 weeks ending June 14, more than any other metro, followed by Las Vegas (-6.7%) and Houston (-5%).

“Luxury home prices have been declining since the beginning of the year largely due to an oversupply of expensive newly built homes, and the downward trend has accelerated in the last three months,” said Dallas Redfin agent Pam Henderson. “Luxury buyers tend to take more time finding a home that suits all their wants and needs, touring many homes before they find the perfect fit. They typically aren’t buying a home because they need a place to live, so they don’t have much motivation to rush their search. Due to COVID-19, a lot of potential luxury buyers are putting their searches on hold because they don’t want to be out touring homes and increasing their risk of infection.”

In some areas, luxury home prices have continued to rise even with the pandemic. Prices rose most year over year in three East Coast metros: Providence (14.7%), Montgomery County, PA (11.2%) and Fort Lauderdale, FL (8.6%).

In Nashville, the typical luxury home sold for $1,155,099 in the 12 weeks ending June 14, a year-over-year increase of 7.3%.

“When businesses began to reopen in May and June, pent-up homebuyer demand pushed up prices in the Nashville area,” said local Redfin agent Mike Estes. “That’s especially true in wealthy suburbs like Franklin and Brentwood, which have a lot of buyers moving in from out of state with high-paying jobs who want a larger, more luxurious home than they could get in California or New York. I’ve had more than one client sell a 1,200-square-foot home in California for over $1 million and buy a 5,000-square-foot home with high-end finishes in a luxury gated community.”

Summary of luxury market (top 5%) by metro area (49 most populous), 12 weeks ending June 14

| Metro area | Median sale price | Median sale price, YoY change | Supply of homes for sale, YoY change | New listings, YoY change |

|---|---|---|---|---|

| Dallas, TX | $956,534 | -12.0% | -18.9% | -8.0% |

| Las Vegas, NV | $889,103 | -6.7% | 3.6% | -16.5% |

| Houston, TX | $930,323 | -5.0% | 2.4% | -14.9% |

| Sacramento, CA | $1,144,646 | -5.0% | -4.8% | -7.8% |

| Baltimore, MD | $840,913 | -4.9% | -12.6% | -24.4% |

| Chicago, IL | $ 1,045,833 | -4.1% | -16.8% | -32.2% |

| Riverside, CA | $1,023,050 | -4.0% | -17.1% | -25.7% |

| Minneapolis, MN | $811,349 | -3.7% | 3.4% | -17.1% |

| Denver, CO | $1,232,792 | -3.4% | 14.2% | -4.4% |

| Jacksonville, FL | $933,282 | -2.6% | -9.5% | -21.1% |

| Cincinnati, OH | $605,168 | -2.6% | -6.9% | -6.8% |

| Portland, OR | $1,057,825 | -2.5% | 6.3% | -9.0% |

| Milwaukee, WI | $665,346 | -1.6% | -6.1% | -21.4% |

| San Antonio, TX | $639,859 | -0.6% | 13.7% | 8.1% |

| Detroit, MI | $524,813 | -0.3% | 42.3% | 7.5% |

| Fort Worth, TX | $777,946 | -0.2% | -9.5% | -12.8% |

| San Francisco, CA | $1,694,458 | 0.2% | 6.9% | -19.5% |

| Oklahoma City, OK | $513,743 | 0.3% | 2.5% | -6.3% |

| San Jose, CA | $1,520,292 | 0.5% | -20.7% | -32.9% |

| Boston, MA | $1,514,542 | 0.9% | -14.2% | -32.9% |

| Atlanta, GA | $899,725 | 0.9% | 31.3% | 20.8% |

| Columbus, OH | $655,323 | 0.9% | -21.5% | -30.0% |

| Miami, FL | $1,655,125 | 1.1% | -4.0% | -30.9% |

| Orlando, FL | $819,382 | 1.3% | -4.6% | -14.9% |

| Oakland, CA | $1,372,417 | 1.5% | -17.0% | -25.2% |

| Los Angeles, CA | $1,553,271 | 1.8% | -19.9% | -31.4% |

| Seattle, WA | $1,454,200 | 1.8% | -27.7% | -27.2% |

| Pittsburgh, PA | $607,162 | 1.9% | -0.9% | -13.4% |

| Virginia Beach, VA | $685,779 | 2.0% | -15.6% | -13.3% |

| Charlotte, NC | $937,265 | 2.2% | -15.7% | -26.0% |

| Anaheim, CA | $1,485,087 | 2.2% | -28.8% | -36.3% |

| Philadelphia, PA | $885,291 | 2.4% | -13.4% | -29.2% |

| Phoenix, AZ | $1,102,917 | 2.8% | -20.6% | -17.0% |

| Newark, NJ | $1,201,500 | 2.8% | -18.3% | -24.6% |

| Indianapolis, IN | $615,625 | 3.3% | -11.8% | 1.4% |

| Nassau County, NY | $1,515,229 | 3.5% | -24.1% | -42.5% |

| Warren, MI | $712,083 | 3.8% | 42.9% | 25.8% |

| St. Louis, MO | $705,689 | 3.9% | -23.1% | -36.8% |

| Austin, TX | $1,246,866 | 3.9% | 9.1% | -4.5% |

| Washington, D.C. | $1,306,900 | 4.7% | -2.5% | -26.8% |

| San Diego, CA | $1,529,417 | 5.1% | 0.2% | -3.8% |

| Cleveland, OH | $551,122 | 5.7% | -14.9% | -26.4% |

| Nashville, TN | $1,155,099 | 7.3% | -2.1% | 4.5% |

| West Palm Beach, FL | $1,696,365 | 7.8% | -4.8% | 7.8% |

| New Brunswick, NJ | $1,298,361 | 7.9% | -17.9% | -26.7% |

| Tampa, FL | $989,779 | 8.4% | -4.5% | -10.2% |

| Fort Lauderdale, FL | $1,178,643 | 8.6% | -12.2% | -24.5% |

| Montgomery County, PA | $1,055,924 | 11.2% | -12.8% | -32.6% |

| Providence, RI | $1,049,542 | 14.7% | -9.3% | -28.1% |

| National | $1,099,521 | -2.3% | -6.7% | -19.3% |

Methodology

We divided all U.S. residential properties into five buckets. There are three equal-sized tiers based on Redfin Estimates of the homes’ market values as of mid-June, with separate buckets for the bottom 5% and top 5% of the market. The top 5% of the market by price is considered luxury for the purposes of this report. The “bottom” tier represents more affordable homes, or homes estimated to be in the 6th-35th percentile. The “middle” tier represents homes estimated to be in the 36th-65th percentile. The “top” tier represents more expensive homes, or homes estimated to be in the 66th-95th percentile. We report on the “bottom” or “affordable” tier and the “top” or “expensive” tier in this separate report. By using Redfin Estimates of homes’ market value, we are able to use the same group of homes to report on price, sales and inventory. In past luxury reports, Redfin has analyzed the top 5% of homes by sale price to report on luxury price trends, while analyzing homes above a certain price threshold (typically $1.5 million or $2 million) for sales and inventory data.

The post Luxury Home Prices Dropped 2.3% This Spring, Reversing Course From Pre-Pandemic Growth appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.